INTRODUCTION:

The Government of Maharashtra vide an Orderdated 15th January 20081 which was amended by another Order dated 6th January 20152 (“the said Orders”), has reduced the stamp duty by 50% (Fifty percent) as otherwise chargeable under Article 25 (b) and (d) of Schedule-I to the Maharashtra Stamp Act, 1958 (“the said Act”), on the instrument of first Agreement or Conveyance relating to the sale of property located in the area notified as “the Special Township Project” till the completion period specified in the sanction to the Integrated Township Project / Special Township Project by Urban Development Department (“UDD”) /Planning Authority.

The Government of Maharashtra has sanctioned the revised Integrated Township Project Regulations vide three separate notifications for different planning areas (“the said Regulations”) and in which there is a provision to grant concession of fifty per cent of stamp duty as otherwise chargeable under the provisions of the said Act for the purchase of land by project proponent for township area or for the first transaction from project Proponent/s to the Purchaser of any unit under any user from approved Master Layout Plan or subsequent building plan under the said Regulations for the development of Integrated Township Project and also on the instrument of transaction of assignment of the rights from project proponent/sto its own subsidiary company for the running of the amenities in such township project as per approved plan relating to the immovable property located in the areas of Integrated Township Project (‘ITP’), as notified under the regulations under the Maharashtra Regional and Town Planning Act, 1966 “the MRTP Act’”).

THE 2023-ORDER:

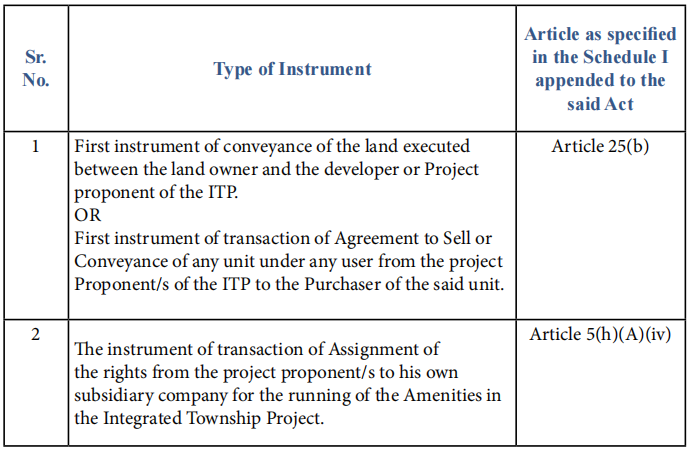

Now, in supersession of the said Orders, the Government of Maharashtra, being satisfied that it is necessary to do so in the public interest, in order to develop the said ITP, retrospectively with effect from the 20th November 2018, vide the order dated 20th June, 20233 published in the Maharashtra Government Gazette (“the 2023-Order”) has reduced the stamp duty to the extent of fifty per cent. as otherwise chargeable on the following instruments relating to the property located in the areas of Development Plans and Regional Plans, as the case may be, approved for the development of ITPs under the regulations under the MRTP Act (“MRTP Regulations”).

CONDITIONS UNDER THE 2023-ORDER:

To avail the benefits of/under 2023-Order, the following conditions will have to be met:

(1) The concerned Collector or the Competent Planning Authority, authorized by the UDD in this behalf, shall certify the eligibility of any project proponent to avail the concession by providing ‘Stamp Duty Remission or Reduction Certificate’, in form appended to the 2023-Order.

(2) The Project shall be a notified ITP or the project proponent/s shall produce a ‘document of In-Principle Approval’ issued by the concerned Collector or the Competent Planning Authority for developing an ITP under the MRTP Regulations.

(3) The Master Layout Plan or subsequent building plan of an ITP under the MRTP Regulations must be sanctioned or approved by the concerned Collector or the Competent Planning Authority, as the case may be.

(4) The project proponent/s or purchaser of any unit under any user or any subsidiary company of any project proponent/s which has availed the remission or reduction under the 2023-Order shall not be entitled for remission or reduction of stamp duty as per any other order or policy of the Government of Maharashtra.

(5) No refund shall be granted where full or proper stamp duty has already been paid by any of the project proponent/s or purchaser of any unit under any user or any subsidiary company of any project proponent/s of the said ITP, prior to the date of publication of the 2023-Order in the Maharashtra Government Gazette.

(6) Any project proponent/s or purchaser of any unit under any user or any subsidiary company of any project proponent/s for which the remission or reduction in the stamp duty is granted under this Order, and which fails to fulfill the purpose or objectives of the said policy or commits breach of any of the conditions or special regulations as specified in the said notifications or the said policy or this Order, shall be liable to pay the whole stamp duty and penalty, if any, as if there was no reduction in stamp duty from the beginning.

EXPLANATION TO THE 2023-ORDER:

(1) For the purposes of 2023-Order, a unit means, a shop or a residential or a commercial unit or any type of immovable property for any user.

(2) The remission or reduction in stamp duty under the 2023-Order is applicable only once either for

(i) the project proponent of the said ITP for the purchase of land from the land owner or (ii) for the instrument of transaction of agreement to sell or conveyance of any unit under any user in the notified ITP only from the project Proponent/s of the said notified ITP to the Purchaser of that unit.

(3) For the purposes of the 2023-Order, “the first instrument of transaction” means, the first document executed between ‘the project Proponent/s’ and ‘the Purchaser’ (‘the original purchaser’) in respect of any unit under any user located in the notified ITP area. It does not include the instrument or document/s executed between the original purchaser and the subsequent purchaser of any unit under any user located in that notified ITP area. Thus, further transaction from the original purchaser to the next purchaser is not eligible for the remission or concession in the stamp duty under this Order.

(4) The remission or reduction in the stamp duty under the 2023-Order is available till the completion period specified in the sanction to the ITP/Special Township Project by UDD/Planning Authority.

(5) The existing projects notified as a ‘Special Township Project’ from competent authority specified in this behalf by the UDD, will also be eligible for the Stamp Duty remission or concession under the 2023- Order.

(6) The remission or reduction in stamp duty provided under the 2023-Order is applicable to the property located in the areas of the Development Plans and Regional Plans, as the case may be; thereof approved for the development of ITPs under the regulations of the Regional and Town Planning Act.

NON-APPLICABILITY OF THE 2023-ORDER:

The remission or reduction in stamp duty under the 2023-Order shall not be applicable to the property or unit located in:-

- The ITP areas of Municipal Corporation of Greater Mumbai.

- The ITP areas of Other Planning Authorities or Special Planning Authorities or Development Authorities within the limit of Municipal Corporation of Greater Mumbai, MIDC, Jawaharlal Nehru Port Trust, Hill Station Municipal Councils, Eco-sensitive or Eco-fragile region notified by Ministry of Environment, Forest and Climate Change (MoEF and CC) and Lonavala Municipal Council, in Maharashtra except Navi Mumbai Airport Influence Notified Area (NAINA)

DISCLAIMER

This material has been published by Dhaval Vussonji and Associates, Advocates and Solicitors and is subject to the copyright of Dhaval Vussonji and Associates. The update is not intended to be a form of solicitation or advertising. The material herein contained is a general discussion on the manner in which the Act and the Rules are worded. The examples contained herein should not be used in real life situations and do not constitute any advise given by Dhaval Vussonji and Associates. You are advised to take specific legal advise on the manner of application of the Act and the Rules to you. The provisions of the Act and the Rules discussed herein are subject to interpretation by Courts and concerned authorities and may be amended by the appropriate government. Dhaval Vussonji and Associates is NOT a firm of accountants and does not claim any expertise in advise on accounting principles. Dhaval Vussonji & Associates will not be responsible for any reliance placed on the material contained herein.