Sec 194-IC is a withholding tax provision wherein it specifically deals with the deduction of tax at source (hereinafter referred as “TDS”) on transfer of land or building or both by resident (hereinafter referred as “Act”). In this connection, Sec 194-IC of the Act is reproduced in verbatim hereunder:-

194-IC. Notwithstanding anything contained in section 194-IA, any person responsible for paying to a resident any sum by way of consideration, not being consideration in kind, under the agreement referred to in sub-section (5A) of section 45, shall at the time of credit of such sum to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to ten per cent of such sum as income-tax thereon.

On perusal of the language of the above provision, it may be appreciated that the scope of section 194-IC of the Act is restricted towards the “specified agreement” referred in sec 45(5A) of the Act (in other words unregistered agreement is not covered within sec 45(5A) of the Act, then in such circumstances sec 194-IC of the Act becomes inoperative). Further, the transferor of land or building or both must be resident. Accordingly, the relevant extract of sec 45(5A) of the Act is reproduced hereunder:-

(5A) Notwithstanding anything contained in sub-section (1), where the capital gain arises to an assessee, being an individual or a Hindu undivided family, from the transfer of a capital asset, being land or building or both, under a specified agreement, the capital gains shall be chargeable to income-tax as income of the previous year in which the certificate of completion for the whole or part of the project is issued by the competent authority; and for the purposes of section 48, the stamp duty value, on the date of issue of the said certificate, of his share, being land or building or both in the project, as increased by the consideration received in cash, if any, shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset :

Explanation-For the purposes of this sub-section, the expression:

(i) “competent authority” means the authority empowered to approve the building plan by or under any law for the time being in force;

(ii) “specified agreement” means a registered agreement in which a person owning land or building or both, agrees to allow another person to develop a real estate project on such land or building or both, in consideration of a share, being land or building or both in such project, whether with or without payment of part of the consideration in cash;

(iii) “stamp duty value” means the value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of an immovable property being land or building or both.

On conjoint reading of sec 45(5A) and sec 194-IC of the Act, it can be fairly inferred that sec 45(5A) mainly deals with transfer of land or building or both being a “Capital Asset” and further, sec 45(5A) of the Act is the part of sec 45 of the Act which is governing provision of “Capital Gain”. Therefore, if any land or building or both which has been classified as stock in trade in the books of accounts, which has been transferred subsequently, then in such circumstances the said transaction is outside the ambit of sec 45(5A) of the Act on account of not being a capital asset and accordingly, the payer (transferee) is not required to deduct TDS u/s 194-IC of the Act. Further, the legislature has also explicitly stated the above discussed proposition in the “Memorandum to Finance Bill 2017” and on perusal of the said memorandum it can be safely inferred that the purpose behind introduction of sec 194-IC in the Act is to cater the TDS requirement arises from the transfer of land or building or both being a capital asset u/s 45(5A) of the Act.

It may also be noted that on perusal of the language of sec 194-IC of the Act it can be perceived that the liability to deduct TDS arises only when the transferor receives a part of consideration in “cash or by issue of a cheque or draft or any other mode”. In other words, if there is absence of cash consideration under “specified agreement” then in such circumstances transferee is not required to deduct TDS u/s 194-IC of the Act.

CONDITIONS FOR DEDUCTING TDS U/S 194-IC:-

If the following conditions are satisfied cumulatively, then only the payer is required to deduct TDS u/s 194-IC of the Act:-

- Transferor of land or building or both must be resident Individual or HUF.

- Land or Building or both must be capital asset.

- Land or Building or both must be transferred under “Specified Agreement” referred u/s sec 45(5A) of the Act (i.e., registered agreement).

- Part of the consideration under “Specified Agreement” must be in “cash or by issue of cheque or draft or any other mode”.

If any of the above mentioned conditions fails to satisfy, then in such circumstances the payer (transferee) is not required to deduct TDS u/s 194-IC of the Act.

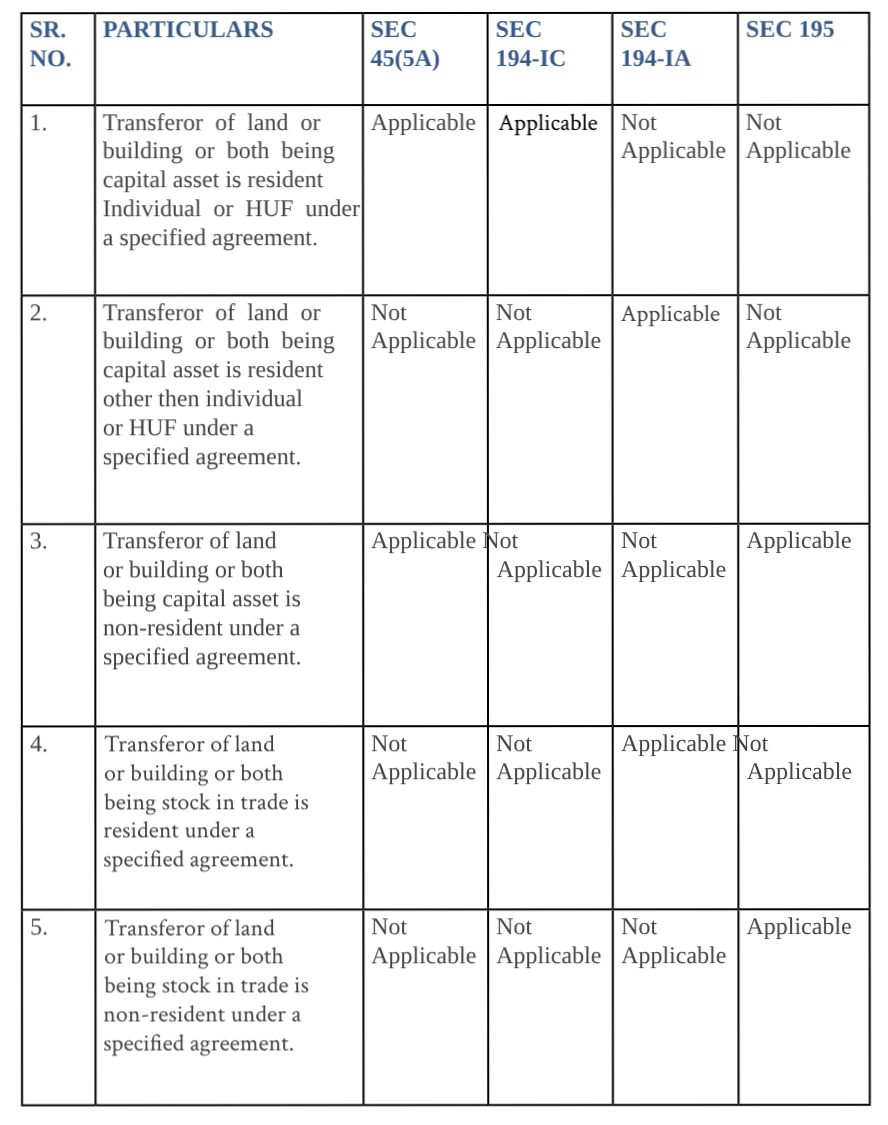

Tabular summary to summarized the implication of sec 45(5A) and sec 194-IC along with its interplay amongst sec 45(5A) and various TDS provisions such as 194-IA, 194-IC and 195 of the Act are reproduced hereunder:-

DISCLAIMER

This material has been published by Dhaval Vussonji and Associates, Advocates and Solicitors and is subject to the copyright of Dhaval Vussonji and Associates. The update is not intended to be a form of solicitation or advertising. The material herein contained is a general discussion on the manner in which the Act and the Rules are worded. The examples contained herein should not be used in real life situations and do not constitute any advise given by Dhaval Vussonji and Associates. You are advised to take specific legal advise on the manner of application of the Act and the Rules to you. The provisions of the Act and the Rules discussed herein are subject to interpretation by Courts and concerned authorities and may be amended by the appropriate government. Dhaval Vussonji and Associates is NOT a firm of accountants and does not claim any expertise in advise on accounting principles. Dhaval Vussonji & Associates will not be responsible for any reliance placed on the material contained herein.