Reference may be made to our Article titled ‘The Sixth Type of Transfer’ published on 17th August, 2018, wherein we had explained the various transfers in India and type of rights under the Maharashtra Land Revenue Code, 1966 (“Code“). To have a better understanding of this Article, this Article should be read in conjunction with our previous Article.

Throughout Maharashtra, including the city of Mumbai and Thane, the State Government has granted various lands on Occupancy Class II basis or Leasehold basis for varied purposes such as commercial, industrial, residential, educational, etc. While granting such lands on Occupancy Class II basis or Leasehold basis, the State Government had imposed certain restrictions on the grantee, including on the transfer, mortgage and/or use of such lands by the grantee and hence, prior permission and payment of certain premiums would be required to be made to the State Government beforehand.

The genesis of this restriction is that when such Government owned lands are mortgaged, third party interests are created which results in a deviation from the original intent of the grant, as the grant was made to the grantee for a specific purpose such as commercial, industrial, residential, educational, etc.. To add to that, the grant was also made at a fraction of the market value of such lands. Therefore, it is only fair for the landowner (i.e. the State Government) to charge a fee/ premium, when such lands have helped the grantee to raise finance.

Therefore, with the intent to have a fixed policy of charges payable on such mortgages, the Revenue and Forest Department, Government of Maharashtra passed a Government Resolution dated 27th February, 2009 bearing No. Land 2000/Pra. Kra. -135/J-1 as regards the fees payable for the issuance of permission by the State Government for mortgage of lands held on Occupancy Class II basis or Leasehold basis and has also laid down various terms and conditions of such mortgage.

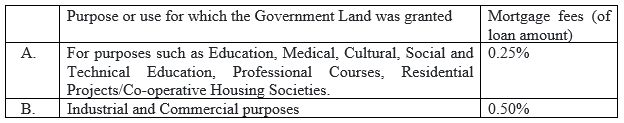

In accordance with the same, the premium payable in terms of the aforesaid Government Resolution is as under:

It is to be noted that the aforesaid charges are to be paid prior to the creation of mortgage, although the charges are based on the loan amount.

The State Government has also made it clear that in the event the grantee fails to repay the loan, then the lender shall be solely responsible for the recovery of the loan and the State Government will in no manner be liable for the same. Further, in certain circumstances, where the situation arises for the lender to enforce the mortgage and sell or auction such lands, prior permission of the State Government will be required and upon completion of such sale or transfer, the right of the State Government to recover the unearned income for such sale or transfer shall be first and exclusive, above all charges, including of the lender.

Therefore, for a lender to recover its dues, it is important to note that the mortgage is only enforceable upon grant of permission and payment of premiums at the time of such enforcement.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.